How to Recognize Fake Pay Stubs

Pay stubs are important documents that provide information about an individual’s earnings and deductions. They play a crucial role in various financial transactions, such as applying for loans, renting properties, or verifying income for employment purposes. Unfortunately, the rise of fraudulent activities has made it necessary to learn how to recognize fake pay stubs to protect against potential scams. This article will guide you through the process of identifying red flags and distinguishing genuine pay stubs from counterfeit ones.

Check for Consistency and Accuracy

One of the first steps in recognizing fake pay stubs is to examine the consistency and accuracy of the information presented. And if you want to care about your pay stubs easily, here is a website to create pay stubs for Virginia and other locations. Pay attention to the following details:

Employer Information: Verify if the company name, address, and contact details are legitimate. Cross-reference the information with public records or reach out to the company directly for confirmation.

Employee Details: Ensure that the employee’s name, address, and Social Security number (or equivalent identification number) match the individual’s known information. Discrepancies or misspellings can be warning signs.

Payment Information: Look for consistent payment dates, amounts, and payment methods. Discrepancies, such as irregular or inflated earnings, could indicate a fake pay stub.

Analyze the Format and Design

Pay stubs typically follow a standardized format. Analyzing the design elements can help identify potential fraud. Consider the following factors:

Logo and Branding: Authentic pay stubs often feature the company’s logo, name, and other branding elements. Check if these elements appear genuine and match the company’s official branding.

Layout and Formatting: Pay attention to the overall structure, alignment, and font consistency. Fake pay stubs may have irregularities, including inconsistent font styles, spacing, or distorted layouts.

Payroll Software: Many organizations use specific payroll software, resulting in consistent formatting across pay stubs. Familiarize yourself with the common software used by legitimate companies and compare the formatting against known examples.

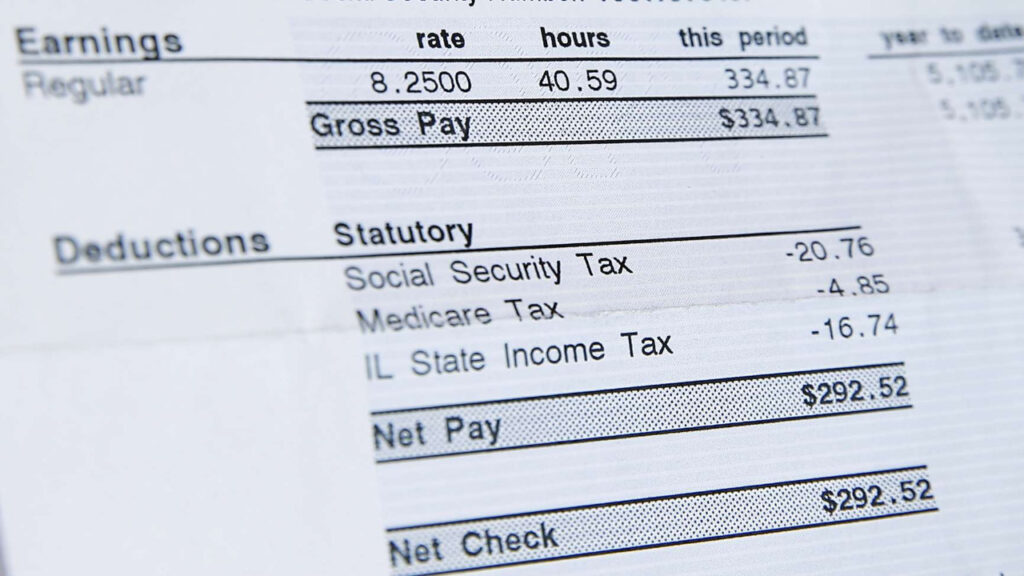

Examine Earnings and Deductions

Pay stubs provide detailed information about an employee’s earnings and deductions. Scrutinize the following aspects:

Earnings: Verify if the income stated aligns with the employee’s position and expected salary range. Unusually high or low earnings could indicate a fake pay stub.

Taxes and Deductions: Check for consistent deductions such as federal, state, and local taxes, Social Security contributions, and insurance premiums. Suspiciously low or missing deductions may raise doubts.

Overtime and Bonuses: Look for indications of overtime hours or bonuses if applicable to the employee’s position. Excessive or unexpected amounts should be carefully examined.

Validate Supporting Documentation

To further validate the authenticity of pay stubs, it is essential to consider additional supporting documentation:

Bank Statements: Compare the deposit amounts and dates on the pay stub with the corresponding entries on the employee’s bank statements. Consistency between the two adds credibility.

Employment Verification: Reach out to the employer directly to verify the employee’s employment status and the accuracy of the pay stub. Legitimate employers will often assist in verifying these details.

Recognizing fake pay stubs requires attention to detail and a thorough examination of various elements. By checking for consistency, analyzing the format and design, examining earnings and deductions, and validating supporting documentation, you can significantly reduce the risk of falling victim to fraudulent activities. Remember, if something seems suspicious, it’s always best to investigate further or seek professional advice to ensure the authenticity of the pay stub.